Car Insurance for a 20 Year Old Girl

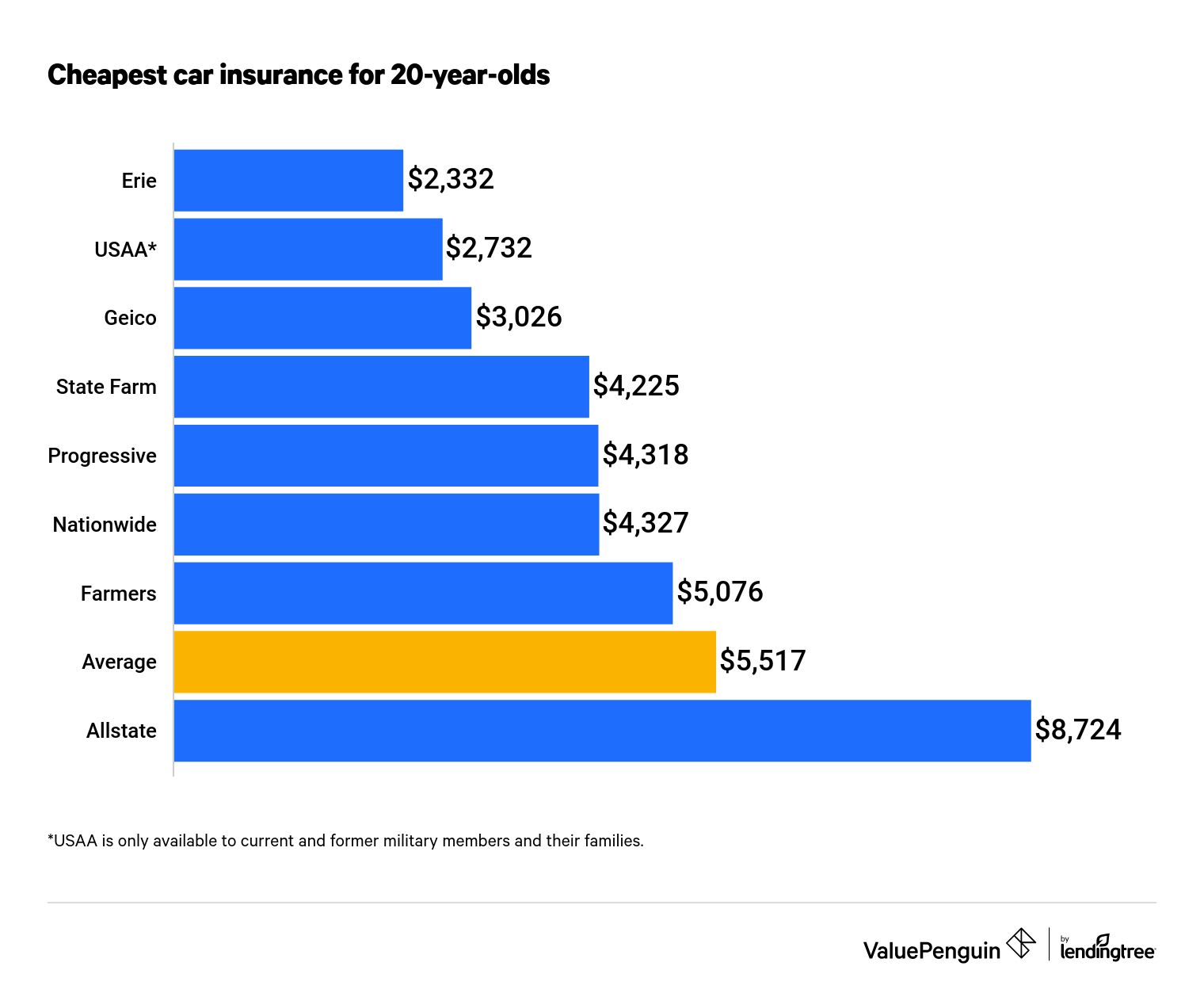

The average cost of car insurance for a 20-year-old is $5,517 per year. Our analysis found that Erie offers the cheapest rates for a 20-year-old driver at $2,332 per year, or $194 per month.

We determined that Erie offers the cheapest car insurance for 20-year-old drivers at $2,332 per year, based on our analysis of thousands of rates across nine states. To find the cheapest rate, you should compare quotes yourself, as we found rates can vary by $6,392 per year.

{"backgroundColor":"ice","content":"\u003C\/p\u003E\n\n\u003Cp\u003E\u003Cdiv class=\"full pad-none align-left clearfix\"\u003E\n\u003Cdiv class=\"twothird pad align-left clearfix\"\u003E\u003C\/p\u003E\n\n\u003Cp\u003EWe determined that Erie offers the cheapest car insurance for 20-year-old drivers at $2,332 per year, based on our analysis of thousands of rates across nine states. To find the cheapest rate, you should compare quotes yourself, as we found rates can vary by $6,392 per year.\u003C\/p\u003E\n\n\u003Cp\u003E\u003C\/div\u003E\u003C\/p\u003E\n\n\u003Cp\u003E\u003Cdiv class=\"third pad align-left clearfix\"\u003E\n\u003Cstrong\u003EFind insurance rates by:\u003C\/strong\u003E\u003C\/p\u003E\n\n\u003Cp\u003E\u003Cdiv class=\"DropdownBox--root\"\u003E\n \u003Cdiv class=\"ReactComponent--root\"\u003E\n \u003Cdiv class=\"js-react-component-rendered js-react-component-DropdownBox\" data-component-name=\"DropdownBox\"\u003E\n \u003Cdiv class=\"Root-sc-z2gssf wGmOn\"\u003E\u003Cdiv class=\"InputDropdown--root DropdownBox--select\"\u003E\u003Cdiv class=\"InputDropdown--field \"\u003E\u003Cselect aria-label=\"selectedOption\" class=\"InputDropdown--select\" name=\"selectedOption\"\u003E\u003Coption value=\"#\"\u003ESelect an option\u003C\/option\u003E\u003Coption value=\"#company\"\u003ECompany\u003C\/option\u003E\u003Coption value=\"#age\"\u003EAge\u003C\/option\u003E\u003Coption value=\"#gender\"\u003EGender\u003C\/option\u003E\u003Coption value=\"#state\"\u003EState\u003C\/option\u003E\u003C\/select\u003E\u003C\/div\u003E\u003C\/div\u003E\u003C\/div\u003E\n \u003C\/div\u003E\n\n \u003Cscript type=\"application\/json\" class=\"js-react-component\" data-component-name=\"DropdownBox\"\u003E{\"title\":\"Select an option\",\"dropdownOptions\":[{\"label\":\"Select an option\",\"value\":\"#\"},{\"label\":\"Company\",\"value\":\"#company\"},{\"label\":\"Age\",\"value\":\"#age\"},{\"label\":\"Gender\",\"value\":\"#gender\"},{\"label\":\"State\",\"value\":\"#state\"}]}\u003C\/script\u003E\n\n\u003C\/div\u003E\n\u003C\/div\u003E\n\u003C\/div\u003E\n\u003C\/div\u003E\u003C\/p\u003E\n\n\u003Cp\u003E","padding":"none"}

How much is car insurance for 20-year-olds?

Erie Insurance, available in 13 states, has the cheapest rates for 20-year-olds at $2,332 per year. USAA, which is only available to military members and their families, was the second most affordable at $2,732 per year.

Among widely available insurance companies, Geico ranked as the most affordable for 20-year-olds, with an average rate of $3,026 per year.

Find Cheap 20-Year-Old Auto Insurance Quotes

It's free, simple and secure.

Allstate rates are particularly expensive, with premiums nearly twice as expensive as the next-priciest competitor, Progressive. If you are a young driver looking for cheap car insurance, it's important to shop around and compare prices to find the cheapest insurer for you.

How does car insurance differ for 20-year-olds compared to other ages?

Car insurance for a 20-year-old costs $5,517 per year on average, or $460 per month.

Young drivers, particularly those 25 and under, tend to have particularly high car insurance rates because they get into more accidents on average and are considered more at risk by insurers.

From the ages of 18 to 20, average rates dropped by almost $2,000 per year. Additionally, rates dropped over $900 per year, on average, between a 20-year-old and a 21-year-old.

| Age | Average annual premium |

|---|---|

| 18 | $7,396 |

| 19 | $6,182 |

| 20 | $5,517 |

| 21 | $4,611 |

| 22 | $4,304 |

| 23 | $4,021 |

| 24 | $3,765 |

| 25 | $3,348 |

20-year-old men pay more for car insurance than women

We found that 20-year-old male drivers pay $5,777 per year on average, which is $519 more than female drivers, who pay $5,258 per year. This is because on average, young male drivers get into more accidents compared to young female drivers.

| Age | Annual cost - male | Annual cost - female | Percentage difference |

|---|---|---|---|

| 19 | $6,468 | $5,895 | 10% |

| 20 | $5,777 | $5,258 | 10% |

| 21 | $4,784 | $4,439 | 8% |

Certain states have banned the use of gender as a pricing variable, so men and women of the same age should pay the same for car insurance in these states:

- California

- Hawaii

- Massachusetts

- Michigan (in certain areas)

- Montana

- North Carolina

- Pennsylvania

The best car insurance company for 20-year-olds in each state

We found that Geico was the cheapest insurer in most states. But these are average rates — the best way to find a cheap rate for yourself is to shop around.

We did not include USAA in these recommendations, as its policies only serve current or former military members and their families. If USAA were included, it would offer the cheapest auto insurance for 20-year-olds in Illinois, Michigan, New York and Texas.

Car insurance prices can range greatly from state to state. Michigan is the most expensive state for car insurance for a 20-year-old driver, with an average rate of $16,367 per year.

Conversely, North Carolina has the cheapest auto insurer for young drivers. The average rate for our 20-year-old was $2,035 per year, and it was the only state with a rate below $3,000.

| State | Average annual premium for a 20-year-old |

|---|---|

| North Carolina | $2,035 |

| California | $3,101 |

| Ohio | $3,373 |

| Illinois | $4,422 |

| Georgia | $4,809 |

| New York | $4,827 |

| Texas | $5,154 |

| Florida | $5,698 |

| Michigan | $16,367 |

| Average | $5,517 |

The best way for 20-year-olds to find cheap car insurance

The quotes we've collected are just averages, and the truth is that every car insurance quote will be unique to your own driver profile. But there are several proven ways 20-year-olds can save on auto insurance.

Stay on your parents' car insurance policy

If your parents keep you on their policy, it will almost certainly be the cheapest way to get auto insurance coverage. yThe increase in premiums on your parents' policy is likely to be lower than the cost of your own policy.

Shop around between insurers

The exact same 20-year-old could see a difference of hundreds — or even thousands — of dollars between multiple insurers for the same coverage.

In California, for example, our sample 20-year-old driver paid $2,708 per year with State Farm versus $5,885 with Farmers, on average. That's an extreme difference, but even the difference between State Farm, the cheapest insurer, and AAA, the third cheapest, was hundreds of dollars.

If you're a 20-year-old, shop for cheap quotes online and make sure you are getting the same coverage from each. Start with our recommendations for the cheapest in your state, but also expand your search to other insurers, as you never know who may provide the cheapest rate.

Qualify for discounts

When you get quotes, make sure you're getting credit for all the discounts you qualify for, such as:

- Good students (if your grades are above a certain cutoff)

- Drivers who take a defensive driving course

- People with good credit scores

Lower your coverage limits

It's a good idea to purchase enough insurance to cover you for potential liabilities and also damage to your own car. That's why we recommend a full-coverage policy, which covers the cost of damage or injury to others for which you're liable and also the cost of damage to your own vehicle.

However, at a certain point, you may be purchasing too much coverage, and you could save on your premiums by lowering your limits. If you're paying hundreds of dollars more for comprehensive and collision coverage, but your car isn't worth much more than a few thousand dollars, you may end up paying more money to protect your car than it's actually worth.

Methodology

We collected quotes in nine of the most populous states in the country and across thousands of ZIP codes. For our sample driver, we used 20-year-old men and women driving a 2015 Honda Civic EX. All factors affecting rates, except those discussed in this study, were kept consistent to make a fair comparison.

Coverage levels in the full-coverage policy were the following:

| Coverage type | Coverage limits |

|---|---|

| Bodily liability | $50,000 per person/ $100,000 per accident |

| Property damage | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/ $100,000 per accident |

| Comprehensive & collision | $500 deductible |

| Personal injury protection | Min. when required by state |

We included 29 insurers in this analysis, and insurer rates were only included in our list of average prices and recommendations if their policies were available in at least three of the nine states.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Car Insurance for a 20 Year Old Girl

Source: https://www.valuepenguin.com/20-year-old-car-insurance